The Fight for Talent

by Kristen French and featured in Registered Rep

November, 2010:

When the Morgan Stanley Smith Barney joint venture was announced in January of 2009, Scott Mowry and his team, all former Legg Mason advisors, knew they were not sticking around to see how it would turn out. The group had been looking into joining an independent b/d for two years. They’d been through one major takeover already, when Smith Barney scooped up Legg, and had given the culture of a big Wall Street firm a try. It wasn’t the right fit. The hasty, desperate dealmaking, the bad mortgages on both firms’ books, the ugly headlines and the TARP handouts, these things just pushed them over the edge.

So when the MSSB retention pacakges landed on their desks, they didn’t put their pens to paper. “We felt that was a pretty good tell that we were pursuing other options, but we executed pretty soon after that,” he says. In June of 2009, the team joined Raymond James Financial Advisors.

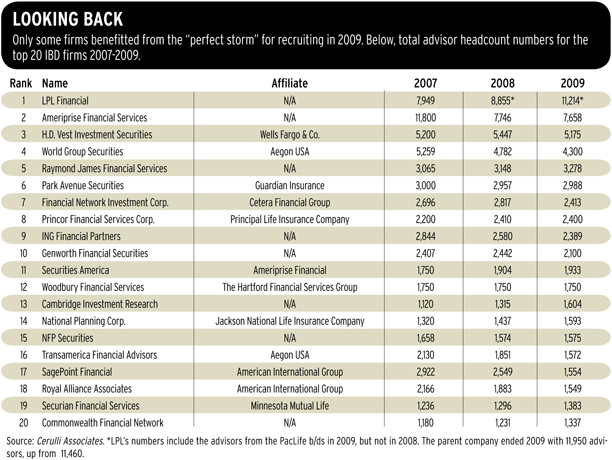

Like Mowry, hordes of advisors switched firms and channels in 2009. The result was a record recruiting year for a handful of independent broker/dealers (IBDs). This year is different: IBD recruiting is limping along, off by half at some firms. Overall, hiring in the channel is probably down 25 percent or more in terms of headcount, some experts estimate. So much so, that some firms have laid off in-house recruiters en masse.

Some IBDs are adding new staff and investing in technology and support programs to prepare for a pickup in FA hiring in 2011. But the future looks pretty flat. Cerulli Associates projects that total headcount in the IBD channel will climb just 0.8 percent over the next five years, 2.8 percent if you include dually registered firms. The channel’s market share in terms of assets should do a little better, according to Cerulli’s projections, rising to 16.6 percent in 2012 from 14.9 percent in 2009. But competition for talented recruits is going to get tougher, say recruiters and analysts. Only a handful of really standout independent broker/dealer firms will be able to rely on recruiting for growth.

A Perfect Storm…For A Few

Breakaway brokers like Mowry represent perhaps the biggest cohort of channel hoppers in 2009. FAs left the wirehouse firms by the thousands. Morgan Stanley Smith Barney got hit hardest, shedding over 4,000 FAs, while net new client assets declined by $12.5 billion; Bank of America Merrill Lynch coughed up a little over 1,000 advisors and recorded a net decline in total client assets (due to both asset outflows and market depreciation) of $250 billion for the year; UBS, meanwhile, lost around 1,100 advisors, but gained net CHF55 billion in total client assets; and Wells Fargo shed just under 300 FAs and gained a net $130 billion in total client assets. Many of these departing advisors resurfaced at the likes of LPL, Raymond James, Commonwealth Financial and other independent b/ds. (Regional b/ds and RIAs took an even greater share of this “breakaway broker” cohort).

But there were other events that drove last year’s recruiting blitz, too. AIG shopped its b/ds around for months before deciding to keep them. That, combined with the firm’s financial missteps, resulted in a loss of close to 2,000 financial advisors, according to Cerulli Associates data. Most of these departing advisors went to other independent b/ds. ING did, in fact, sell off its three b/ds to Lightyear Capital, which renamed them Cetera Financial Group, and together, these b/ds gave up around 1,200 advisors in the process, according to the same data. And then LPL decided to roll its three PacLife b/d’s into its own network, instead of allowing them to remain independent. That decision was unpopular with many PacLife advisors, who wanted to continue using Pershing as their custodian. LPL declined to disclose its recruiting numbers, but as a whole (including independent RIAs and former PacLife advisors), it ended 2009 with a net gain of just 490 FAs, according to Cerulli’s numbers. And that, despite a consensus among recruiters that it had enormous success hiring away wirehouse advisors last year.

And so, 2009 was the perfect storm for IBD recruiting, everyone thought. But here’s the funny thing. In a channel with around 1,000 b/d firms, maybe only a dozen firms benefitted substantially, say recruiters. So many others were left scratching their heads, wondering where all those so-called breakaway brokers (and former insurance b/d switchers) were hiding. In fact, total headcount in the independent b/d channel only rose 0.1 percent in 2009 versus the previous year, according to Cerulli data. (Assets in the channel grew 27 percent to $1.54 billion, the same data show.)

“All the activity to the independent channel never materialized the way the independent channel had hoped,” says Jonathan Henschen, a recruiter with Henschen & Associates in St. Croix, Minn., who works primarily with independent b/ds. “I talked to a lot of wirehouse guys. The ones that were active with the wirehouse reps were firms where that’s their target market anyway: Raymond James, LPL, Commonwealth.” (Wells Fargo’s Finet also recruited a fair number of wirehouse advisors, not including advisors from its own full-service arm.)The other diaspora, out of insurance b/ds and PacLife, mostly benefitted a handful of boutique independent b/d firms. The IBDs that had most success with departing AIG reps included Ausdal Financial Partners, Summit Securities Group, Cambridge Investment Research, First Allied Securities and Commonwealth Financial Network — firms with a history of stability and financial viability, says Henschen. Summit Securities Group also picked up a big number of the fleeing PacLife reps. And Securities America was a beneficiary of the insurance b/d exodus, as well. In general, though, the ING reps who left for other firms scattered more widely, he says.

Not The New Normal

This year, a lot more advisors are staying in their seats. The insurance b/ds have, for the most part, stabilized and are no longer hemorrhaging advisors. And, unlike Mowry, many wirehouse advisors did sign their retention agreements, and are now locked in for close to a decade with golden handcuffs. Those who didn’t sign have, for the most part, already made their moves. So have the smaller advisors with under $500,000 in production who didn’t get retention and, in some cases, saw their pay docked by new banking parents. And finally, those who still do want to move know that they can just cross the street to a rival wirehouse firm and get an enormous recruiting bonus — up to 330 percent of trailing 12-month production for the best advisors, which is a far cry from what independent b/ds can offer. (IBD “transition” money peaked at about 40 percent of trailing 12 months production in 2008 and 2009 at some IBD firms, but now the maximum is half of that, say recruiters.)

“When you think about what you have, you have an established business. Then you’d have a total disruption, where there’s no upfront money, or limited upfront money, and you’re walking away from deferred money, it just doesn’t make any sense at some point,” says one Merrill Lynch advisor who is in his 60s and had been considering going independent for several years, but recently decided against it. He prefers the independent model, he says, and making the switch might make sense for his younger partner — but for him, not so much. “Age matters,” he says. “In the end, it’s somewhat of a zero sum game. You have to adjust to the competition. The ones with the checkbook have the advantage.”

Not only are there no major industry events to spur advisor moves, the current state of the market doesn’t encourage recruiting. “Right now it’s unusually low because we’ve had down markets for rep’s production and they don’t like moving when their production is so down,” says Henschen. “They don’t like moving when it’s strong, either, because they don’t want to upset the gravy train. So the ideal situation is a flat market. If things stabilize and reps’ production goes up a bit, you might see more movement.”

LPL declined to offer specific recruiting numbers for 2009 or 2010, but one recruiter said the firm let go dozens of recruiters at the end of 2009 and this year. Raymond James’ Financial Advisors says its recruiting is half what it was in 2009, when it added 750 new FAs, with about 70 percent plus joining from the top four wirehouses plus Edward Jones. Commonwealth Financial Network’s recruiting numbers are also off 50 percent this year, says Andrew Daniels, head of recruiting for the firm, putting it below its annual average of 100 advisors. Last year, the firm recruited 140 advisors. Over at Securities America, Gregg Johnson, director of branch office development, declined to offer specific numbers, but said recruiting is back in line with 2007 and mid-2008.

The picture for Wells Fargo Advisors Financial Network (FiNet) is less grim. Wells expects to recruit 170 to 180 advisors this year, down 17 percent or more from last year, when it reeled in 218. Still, that exceeds the firm’s 2008 number, and it expects a strong year in 2011. “We’ve had a record number of leads come into the firm this year,” said John Peluso, president of FiNet. “People are taking longer to make a decision though, because things have calmed down. There’s more certainty in terms of what Wells’ rival firms look like today.”

Cambridge Investment Research, meanwhile, recruited advisors corresponding to $71 million in new production in 2009, about $20 milion of which was related to the PacLife b/ds, says Kyle Selberg, senior vice president of business development. This year, through September, the firm has recruited about $50 million. “Our belief is that we can continue to recruit at least 20 percent of the previous year’s revenue, says Cambridge’s Jim Guy, First Executive Vice President and a member of the board.

Exploiting Others’ Trouble

The recruiting landscape has changed in other ways this year, too. Some b/ds are actually finding a new source of hires: advisors orphaned by the smaller firms that have had net capital violations due to lawsuits concerning bad private placements, Provident and Medical Capital. Okoboji Financial and Cullum & Burks Securities both went belly up this year as a result, for example, while GunnAllen Financial filed for bankruptcy protection. And industry insiders say there will be more to come. QA3 Financial, National Securities, CapWest Securities, Independent Financial Group, Investors Capital Corp. and Centaurus Financial have all been subpoenaed and/or sued over their sale of private placements. Securities America has also been subpoenaed, but has the capital and resources to stay afloat.

“In 2009, it was the big brand names, the wirehouses, the three-letter conglomerates,” says Cambridge’s Selberg. “In 2010, we’re seeing reps looking for the same thing, but coming for other reasons. It’s all the things you’ve read about smaller firms having net capital issues, smaller and bigger firms having struggles with due diligence.”

Of course, the firms have to be careful with these advisors. “The firms that had a lot of exposure to Provident and Medical Capital have been getting hit up by other firms, but for those reps who hold a lot of these investments, they’re somewhat toxic to other b/ds and so firms are leery of bringing them on due to litigation exposure,” says Henschen. “Theoretically, litigation would be aimed at the b/ds that let them sell the stuff in the first place, but if those b/ds go belly up, the liability then transfers to the advisors’ new b/d. So firms that are going after these reps are picking up the reps that don’t have exposure to those products.”

Securities America is also tapping this market. “We feel we’ve developed a strong expertise in helping those smaller b/ds assess options, whether looking to sell, move the reps,” says Johnson. The firm recently announced that Equitas out of Detroit, Mich., is going to wind down its b/d and about 25 to 30 of its 45 advisors will affiliate with Securities America under an exclusive recruiting agreement between the firms. “We probably had stages of discussion with a dozen or more b/ds like that in the last 18 months, but only pulled the trigger with Equitas,” says Johnson.

Looking Out

Knowing the competition for recruits is going to be stiff in the future, some firms are investing now in recruiting personnel, technology and support. Wells Fargo invested in several new hires to the independent business earlier this year, adding three new regional directors, who are responsible for recruiting advisors and teams, as well as three internal associate directors to support them. “We believe we’ll compete well,” says John Peluso, president of Wells Fargo Advisors Financial Network. “We are investing in our business at a time maybe when others are looking at it slightly differently. Results are down, but we’ve added the talent in anticipation that the trend is real.” Peluso says the firm is expecting 200 to 225 recruits in 2011.

Cetera is also investing heavily in future growth. CEO Valerie Brown says 2010 is a “building year” for the firm. “Our goal for the broker/dealers over five years is to triple our assets,” she says, through a combination of recruiting, support to help existing advisors expand their businesses and acquisition of other b/ds. The firm doubled the size of its recruiting team this year, to around 30 people, and they plan to hire more. It plans to expand its marketing team, too, adding five new marketing positions. “I think the environment continues to be very supportive of the move toward independence,” says Brown.

Other firms are tweaking their support services. Securities America has created an internal blog and online branch exchange forum where branch office managers can share ideas. AIG created a website that streamlines the affiliation process, allowing new advisors to complete most of their registration online, making it practically “paperless.” And Cambridge launched a program this year called Continuity Partners Group, which will provide funded succession for its advisors, something it is hoping will attract aging wirehouse advisors who want to monetize their books before they retire.

But competition for recruits is going to be fierce. “If you were late to the party, you definitely will find it much tougher to grow,” says Alois Pirker, a consultant at Aite Group. “It’s going to be tougher for the indpendent channel to get their hands on really talented, established advisors because they can’t match the wirehouse sign-on bonuses,” he says. “The breakaway movement isn’t going to be wiped out. It’s just going to be at a lower level.”