Taking the Mystery Out of Going Fee-Only

August 14, 2020

By Jon Henschen, WealthManagement.com

The biggest threat to the independent broker/dealer space is the number of advisors going fee-only. Here are some of the costs and considerations for advisors taking that step.

There are two mounting threats to the independent broker/dealer (IBD) channel’s sustainability. The first is the number of advisors retiring, with too few new advisors entering the field to fill those vacancies. The second threat, and even more concerning to the broker/dealers, is the number of advisors choosing to go fee-only.

As the SEC’s adoption of RegBI makes doing transactional business increasingly difficult, numerous broker/dealers are positioning themselves more as RIAs and less as broker/dealers. We’ve had an increasing volume of discussions with advisors who are at the crossroads of: “When is it appropriate to get my own RIA?” and “What kind of costs will we incur?” so we thought it would be illuminating to elaborate on these and other related questions.

At what AUM does it make sense to get our own RIA?

While we’ve seen advisors with as little as $10 million of assets launch their own RIA, $100 million is a common threshold. There are a number of companies that help you set up your RIA and help with the ongoing compliance and administration. How much you want them to do is up to you but delegating those tasks to others will cost around $10,000 to $15,000 annually.

Examples of RIA setup and maintain companies: Foreside, National Regulatory Services (NRS), MarketCounsel and RIA in a Box.

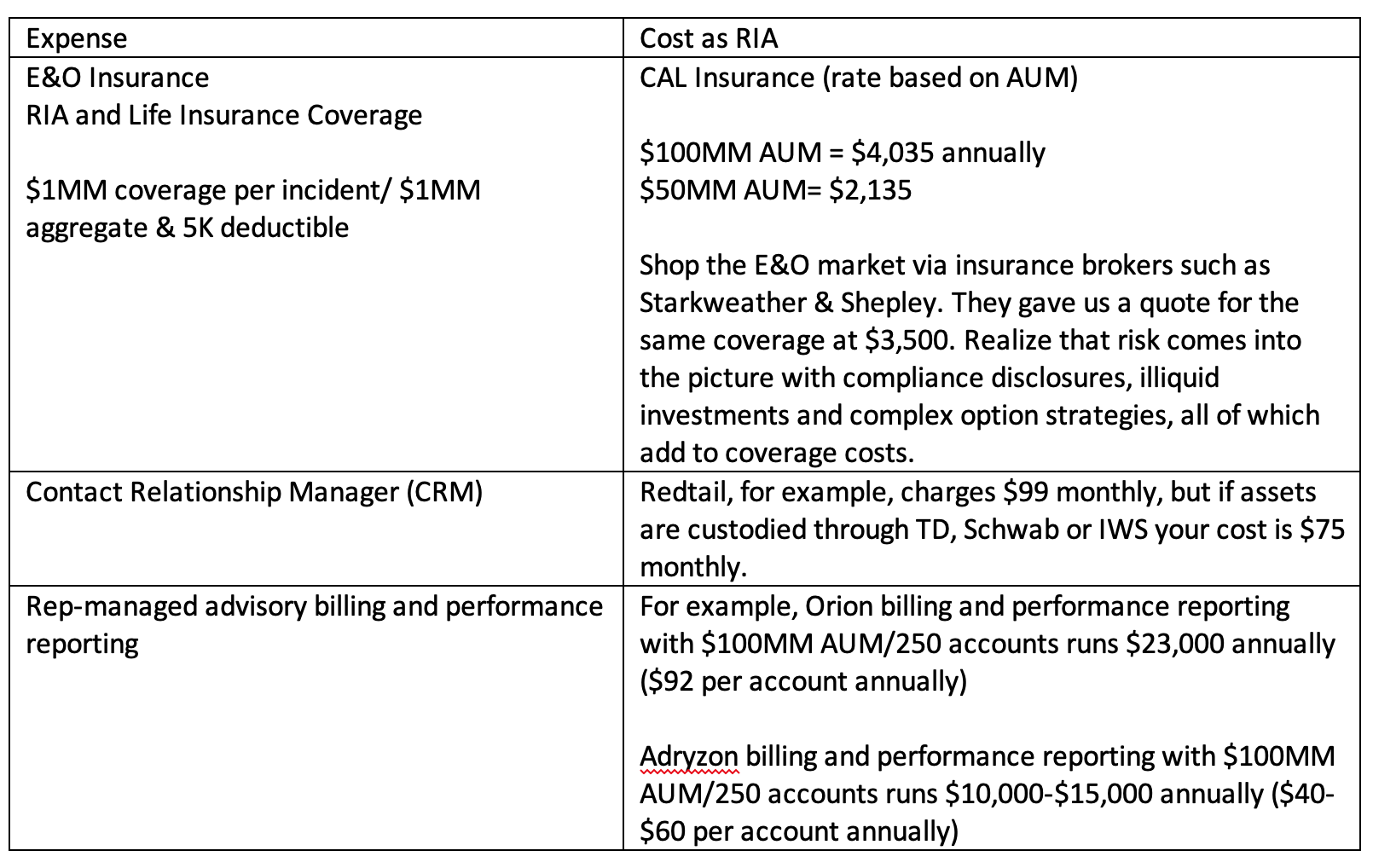

How will my primary advisor costs differ from being with a broker/dealer?

What if I get my own RIA but still have some residual trails and commission business?

There are broker/dealers that pay 100% on the RIA side and they apply a payout only on trails and commissions. If you are no longer doing commission business and have under $50,000 of trail revenue remaining, it’s best to give that up because it is not enough to be worthwhile for these 100% RIA broker/dealers. If you have $50,000-$100,000 of remaining trails, there are options that will keep your expenses low and continue to pay your trails.

What about larger broker/dealers that have the RIA fee-only model?

These options will pay 100% on RIA assets; however, you need to custody your assets in their clearing (not TD, Schwab or IWS) and you are subject to their costs such as administrative fees on advisor-directed assets, which run 3-15 bp on client assets, as well as ticket charges on stocks and ETFs (while you would have zero cost at TD, Schwab or IWS).

These firms have services such as research, practice management, higher-end services and technology offerings that may outweigh their additional costs, which is something you will need to evaluate based on your particular needs.

What about SMA/UMA account costs as an RIA?

The wirehouses have always had the best pricing on SMA/UMA accounts because they have the most scale and assets concentrated on proprietary platforms, with UMA all-in costs as low as 30 bp, while independent broker/dealer costs can be as high as 90 bp or more. There are a few larger independent broker/dealers that have competitive costs on SMA/UMA accounts because they have brought third-party money managers (TPMM), such as Envestnet, in-house (meaning held on the broker/dealer’s clearing platform and to be used by advisors), so they benefit from the scale committed to a single TPMM.

We’ve seen broker/dealers that are sensitive to maintaining a fiduciary standard on their advisory that have been wooed by Envestnet to bring their platform in-house to gain pricing advantage but turned them down due to conflict-of-interest concerns.

A broker/dealer’s motive in bringing Envestnet in-house is to increase profits by having assets concentrated under the one TPMM. This environment frequently shuts out other TPMMs such as Sawtooth Solutions, SEI, Loring Ward and others, thus giving exposure favoritism to Envestnet.

When platforms such as Envestnet are brought in-house, we sometimes receive complaints from advisors who are upset that this also reduces the selection of managers. From a fiduciary perspective, having the scale with Envestnet usually gets the clients better pricing, but on a choice basis, advisors are being pigeonholed, shutting out other money managers that may be a better fit for a particular advisor than what Envestnet offers.

SMA/UMA costs at TD, Schwab and IWS are less than at many of the independent broker/dealers, but a small amount higher than the wirehouses and large IBDs concentrated to a single TPMM or proprietary platform.

Are IBDs enabling moves to fee-only?

Broker/dealers have been expanding penalty charges for not holding advisory assets in their primary profit centers, with platform fees costing the advisor 10 bp if they hold assets at TD, Schwab or IWS, or 5 bp if they hold assets directly at the TPMM. Many larger firms have also been marking up third-party money manager management fees from 10 bp-25 bp with the rationale that the charge is for the cost of ongoing due diligence on managers, but in reality, it’s predominantly a profit center.

Increasingly, broker/dealers are steering assets to their profit center sweet spots, i.e., broker/dealer managed platforms, in-house turnkey asset management platforms like Envestnet and all assets held in brokerage accounts.

We see a growing clash of interests as advisors want to do what is best for the client while the broker/dealer wants to do what is best for their overall profit. The more broker/dealers impose pressure on advisors to use their primary profit centers, the more we’ll see advisors go fee-only and divorce themselves of broker/dealers entirely.