Regulations Throw Sand In The Gears Of Business

March 19, 2021

By Jon Henschen, FA Financial Advisor

The money spent on regulation and whether those dollars are ultimately cost effective in their stated goal rarely correlate. A prime example of this is the brick and tile industry, where the EPA and OSHA imposed rules in an effort to reduce mercury and particulate matter in the environment, which resulted in enormous costs. The industry had already experienced the Brick MACT rule in 2003, which required brick manufacturers to spend millions on scrubbers in order to help control emissions, however that rule was later thrown out.

The EPA requirements passed in October of 2019 will cost the brick and tile industry $100 million annually, with the net result of 118 fewer pounds of mercury and 170 tons fewer of particulate matter being released into the environment. Without having perspective on these numbers, you might wonder, “Why is this problematic?”

If you compare the 118 pounds of mercury to the finite traces of mercury allowed in dental materials used to fill cavities, the brick industry’s reduction under these rules amounts to less than 0.3% of the mercury Americans are collectively carrying around in their mouths. The 170 tons of particulate matter that the brick industry would trim in one year from the increased regulations would be less than the particulate matter produced in one day by U.S fast food restaurants. The bottom line is this: the costs are enormous but the benefits are minuscule.

As with the brick and tile industry, broker-dealers have experienced their own false-alarm regulations, with DOL Fiduciary Rule regulations costing them substantial sums and a great deal of time, but like the Brick MACT rule, never being implemented.

RegBI rules have recently been implemented (rules that requires broker-dealers to make recommendations on financial products that are in the client’s best interest), but will they make a reasonable difference and be cost effective? Having a conversation with the CEO of a midsized broker-dealer having his perspective of RegBI and regulation in general was illuminating. The interview was conducted under anonymity so that he could be frank rather than guarded due to potential regulator retribution.

Jon: How much more are you spending for ongoing execution of RegBI?

CEO: For expenses going forward we are looking at a 2½% increase.

Jon: What percentage of your budget is now dedicated to compliance-related tasks? What was that percentage five years ago?

CEO: 40% of our overall budget is now spent on compliance and compliance-related tasks. Five years ago, this percentage was 30%. [We surveyed six firms that had low compliance activity with the current percentages of budget spent on compliance varying between 30% and 50% and all six showed a 10% increase of overall budget expenses for compliance over the last five years.]

Jon: Do you see RegBI having any benefit to clients?

CEO: Absolutely not. None of this is driven by customer complaints. It’s a tactic to open broker-dealers up to more government regulation and liability. There is no definition of what is “best interest.” Regulators will determine what is best interest. It will be used as a tool for giving regulators additional reasons to come in and impose fines and penalties. It doesn’t fix anything. Regulation likes to keep things opaque because it supplies them with more “gotcha” moments when doing audits. If we ask regulators to be more specific on things like “What exactly is best interest?” they will respond, “We don’t want to tell you how to run your business.” They don’t want clarity because ambiguity is what enables them to impose the high volume of fines you see each year. If fine revenue declines, you see new opaque rules come into the picture.

The Cost Of Regulation Keeps Growing

Regulators often times take on the role of both arsonist and fireman by introducing regulations that create a firestorm in an area of our business that was not problematic prior to the regulations and gives a longer leash to securities attorneys. Then they come in as the hero to put out the fire they created.

The costs of regulation keep growing and the complexity of implementation and tracking of those regulations is adding financial stress to small broker-dealers, especially those with fewer than 50 advisors. Mom-and-pop broker-dealers simply can’t afford to implement RegBI and are being forced to sell or merge with larger firms. What we experience in regulatory burden in the independent broker-dealer channel is similarly played out across many industries.

In the article, “The Cost of Regulation,” author Mark Thornton, senior fellow at the Mises Institute, details the savings to regulation cuts as well as the cost of increasing regulation. “We estimate that reducing the size of the regulatory bureaucracy may grow the economy and invigorate the labor market. Even a small 5% reduction in the regulatory budget (about $2.8 billion) is estimated to result in about $75 billion in expanded private-sector GDP each year, with an increase in employment by 1.2 million jobs annually. On average, eliminating the job of a single regulator grows the American economy by $6.2 million and nearly 100 private sector jobs annually. Conversely, each million dollars increase in the regulatory budget costs the economy 420 private sector jobs.”

A Better Way To Regulate

Smarter regulation that is actually impactful and cost effective would be ideal but we need to go further by taking away older obsolete rules for every new rule added, streamlining the volume of regulation. Before the Chinese Communist Party’s intervention, Hong Kong had consistently ranked #1 on the economic freedom index. One aspect to their success was they had very few government regulations. While the U.S. has reactionary regulation with many business-crushing consequences, Hong Kong had an environment of permissionless innovation that embraced the benefit of “innovation allowed,” which switches the burden of proof to those who favor preemptive regulation and requires them to explain why ongoing trial and error experimentation with new technologies or business models should be disallowed. Regulators had the burden of proof that their proposed regulation not only works, but also cost effective given the circumstance presented.

How Over Regulated Are We?

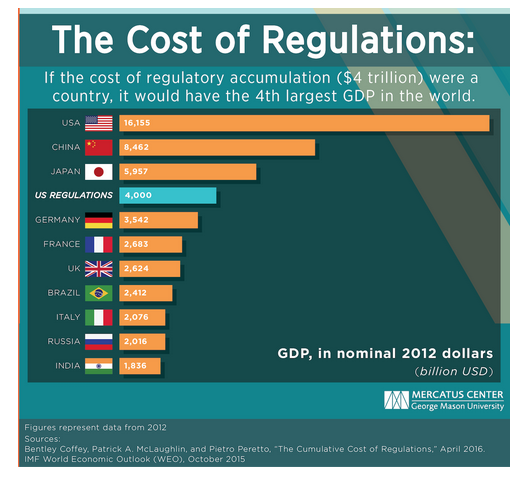

In the U.S., heavy regulation is in direct proportion to heavy crony capitalism, as regulation is encouraged or pushed by lobbyists of large firms to keep smaller competitors at bay. The wirehouses love regulations and spend millions in lobbying efforts to keep them in favor with government officials and competitors at a competitive disadvantage through continued heavy regulation. U.S. regulatory costs ($4 trillion) would be economically equal to the fourth largest country in the world.

Regulation depletes one quarter of U.S. GDP and in 2013 totaled 170,000 pages on a federal level. That’s not counting state and local regulatory pages. The Trump administration had issued 65 percent fewer “significant” rules—those with costs that exceed $100 million a year—than the Obama administration. The Trump administration had pledge to “massively” reduce regulation, but only significantly slowed regulation output. The 170,000 pages in 2013 as of 2018 are up to 185,000 pages. The Biden administration has pledged to step up regulation dramatically across industries. More sand will be thrown into the gears of business and industry.

Jon Henschen is founder of Henschen & Associates, a firm that helps advisors find broker-dealer relationships.