Midsize firm ProEquities picks custodian’s BD over its own

June 22, 2021

By Tobias Salinger, Financial Planning

A midsize wealth manager seeking to expand its advisory business is taking a novel approach from rivals by outsourcing broker-dealer services to its custodian. It’s a move that falls into the industry’s ongoing trend away from commissions and toward advisory fees, and illustrates a new twist in firms’ hunt for costs to cut as business models change.

The move by ProEquities to replace itself with Pershing Advisor Solutions as the introducing BD for its primary type of RIA account, the Advisory Management Plus Platform, follows several years of discussions and due diligence among the firm’s executives on the best “transformational path” to take away from its “old transactional model,” according to ProEquities President Elizabeth “Libet” Anderson. While unrelated, the first wave of some 7,200 accounts migrated to the Pershing BD as ProEquities announced it’s rebranding next month to Concourse Financial Group Securities under a merger with two other Protective Life-owned firms.

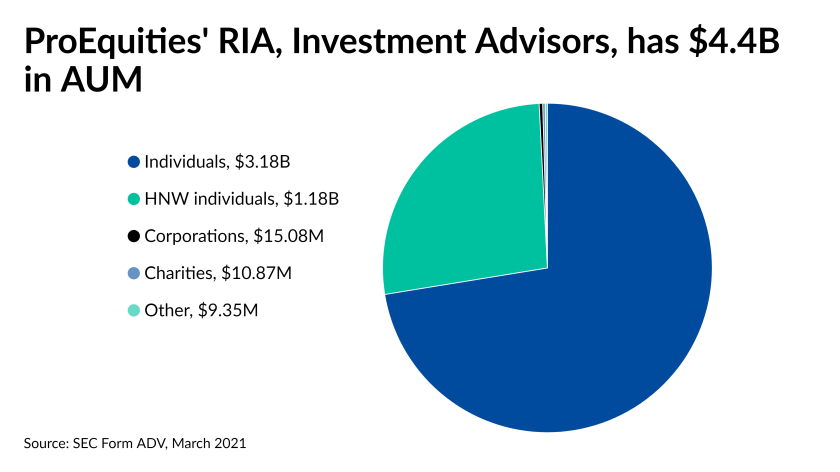

ProEquities, whose parent company is owned by the Tokyo-based giant Dai-ichi Life Insurance, anticipates that the remaining 6,500 accounts will move to Pershing’s BD in early October, Anderson said in an interview. Since BNY Mellon’s Pershing is ProEquities’ only custodian, she notes that the movement of roughly $3 billion in assets under management is technically flowing from Pershing LLC, another BD owned by the custodian, to Pershing Advisor Solutions. The Birmingham, Alabama-based wealth manager opted for the new setup as opposed to picking a different custodian or the more common tactic of working with multiple ones….

While it’s common for custodians’ BDs to work with RIAs that have no FINRA affiliation, the new setup for ProEquities stands out in its sector. The complications posed by the SEC’s Regulation Best Interest likely played a role as well in the firm’s decision “to not make the plunge” to multiple custodians, recruiter Jon Henschen of Henschen & Associates said in an email.

“This is a first I’ve seen where a broker dealer opt out of Pershing in favor of PAS with most firms that are dual-clearing-friendly having the clearing firm option and then, in addition, having the outside options,” Henschen says, noting that most IBDs assess a fee on assets held off their platform with a different custodian.

Read the full article on FinancialPlanning.com