LPL Financial spends big on recruiting in 2019

February 24, 2020

By Bruce Kelly, Investment News

As LPL Financial looks to broaden its recruiting reach this year, it is putting its money where its mouth is: The firm reported a 44.8% increase last year in recruiting bonuses that are used to entice financial advisers to leave a competing broker-dealer and set up shop with LPL.

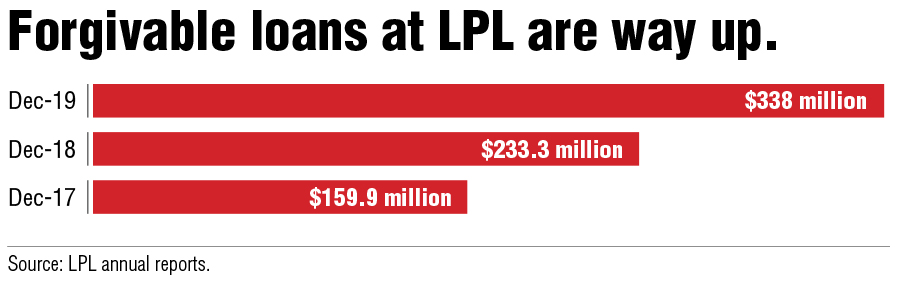

According to its 2019 annual report, which was filed with the Securities and Exchange Commission Friday, LPL reported a balance of $338 million in forgivable loans at the end of 2019, compared to $233.3 million at the end of 2018.

LPL defines the loans, also referred to as forgivable notes in the industry, as “made in connection with recruiting” and “forgivable over terms of up to 10 years provided that the adviser remains licensed through LPL Financial.”

LPL’s forgivable loan total at the end of last year was more than double its balance in 2017, when the company reported $159.9 million in such loans.

LPL, which is the largest independent broker-dealer in the industry with 16,464 advisers, since April 2018 has been selectively offering advisers a bonus in the form of a forgivable loan that pays an adviser at least 50 basis points on assets transferred to LPL’s corporate registered investment adviser, a potentially far more lucrative structure for the adviser than traditional recruiting deals.

The strategy appears to be working. In 2019, LPL recruited advisers with $35 billion in assets under management, a new annual high.

“Our recruited assets under management increased nearly 30% last year, which naturally resulted in an increase in the overall amount of transition assistance we provided to new advisers,” said Rich Steinmeier, managing director and head of business development for LPL. “Our transition package has long been competitive in the market, and our approach in 2019 was consistent with other years.”

Although some details of LPL’s new recruiting plan are still vague, the firm’s CEO, Dan Arnold, made it clear on an earnings conference call with analysts last month that it would be a focus throughout this year.

The bump in forgivable loans at LPL came as no surprise to one recruiter.

“The increase to note money is primarily due to an increase in recruiting numbers but also due to larger basis points on assets being offered,” said Jon Henschen, head of an eponymous recruiting firm. “What LPL has steered the industry toward is basing notes on profitability of the advisers’ assets to a greater degree than what we’ve seen prior to last year, with other firms starting to follow suit.”

In the past, forgivable loans and notes to recruit advisers were almost universally tied to a percentage, such as 20%, applied to overall revenue.

LPL’s recruiting loan pays the largest amount for corporate RIA assets, which are highly profitable, but zero or close to zero for retirement plan assets, Mr. Henschen noted.

“We’re surprised that it has taken this long to base note amounts on an adviser’s profitability, but Dan Arnold has the optics on what makes sense,” he said.