Is Your Broker-Dealer a Doomsday Prepper?

March 11, 2020

By Jon Henschen, ThinkAdvisor

Your BD’s readiness, or lack thereof, to handle a bear market can affect you in many ways.

Doomsday preppers live by the credo, “Hope for the best but plan for the worst.” For broker-dealers, doomsday equates to a long, deep, protracted recession where stock market prices drop 30-40% or more and do not recover for an extended period.

During a recent discussion with an advisor who has 10 years of experience, it dawned on me that he had never experienced a market correction while in the business.

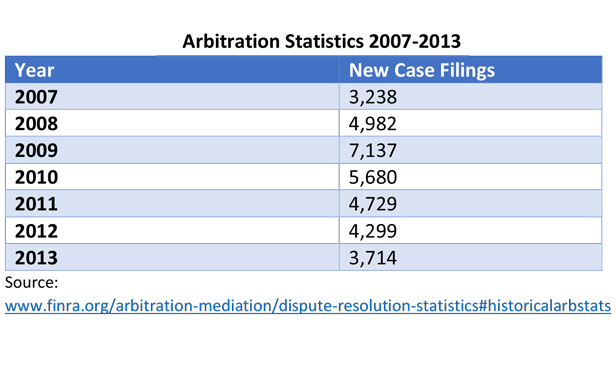

The 2007-’09 market crash resulted in a surge in arbitration filings (dominated by complaints over market losses), as well as a big uptick in tax liens and bankruptcies due to upside-down mortgages that rained on the house-flipping frenzy, as well as drops in production.

- Client accounts are frozen when your broker-dealer falls into a net capital violation. They remain frozen, possibly for several months, until things are worked out or advisors are sold to another firm.

- Staffing is cut due to a drop in cash flow.

- Investment in technology and services is put on hold or there are cutbacks in services.

- Broker-dealer cash flow and net capital are consumed by paying FINRA fines, leaving less available for services.

- Reactive compliance behavior increases paperwork and policies that are more restrictive are implemented.

- Firms vulnerable to market swings lack diversification of hedging strategies or silos of revenue in areas that counter or are unaffected by the market.

How BDs Perform in Market Meltdowns

Here are some pros and cons to how different types of broker-dealers perform in market meltdowns. How severely performance drops depends on how long a bear market persists.

Privately Owned

Commonwealth Financial sets the standard for consistency in all market conditions with the 2008-’09 bear market highlighting its strengths, as the BD experienced no layoffs.

In management’s mind, it was unconscionable that owner profit would take precedence over the well-being of staff, who are the ones who deliver their indispensability, says Andrew Daniels, managing principal of business development.

Another big plus for Commonwealth is that they don’t carry any debt, which gives them greater ability to weather financial storms.

From a recruiting perspective, when our firm evaluates privately owned broker-dealers, we look to their financials over the previous two years via the firm’s recent focus filing with the SEC. Here’s what we look for:

- Is revenue growing or shrinking? If revenue has been shrinking during good markets, poor markets could be a death knell.

- Profit/loss: Is the firm profitable? If a firm hasn’t been profitable over the last few years during favorable markets, what happens to those losses in difficult markets?

- For smaller firms, do they have net capital reserves of $500,000 or more to handle multiple arbitration fines, as well as $2 million to $5 million of aggregate errors and omissions insurance?

- What is the firm’s indebtedness to net capital ratio? (Ratios of 5:1 or higher raise a red flag; ratios under 1:1 indicate a firm with very little debt burden.)

We also look at whether a firm has a high percentage of advisors with multiple disclosures on their FINRA record because when the customer complaints spike, these firms can quickly fall into a net capital violation.

Life Insurance BDs

In a recent conversation with a large insurance broker-dealer, the conversation steered to how well they hold up in bear markets, as the broker-dealer accounts for only 1/16th of the overall revenue of the parent company.

Insurance sales are much less vulnerable to market swings and they are one of the few businesses that thrive in a rising interest rate environment. Having a deep-pocket life insurance company behind you can be an island of stability during a market storm.

Insurance Marketing Organization-Owned BDs

There are a growing number of IMO-owned broker-dealers, as the IMO brings the deep pockets to the broker-dealer. Like BDs owned by insurance companies, IMO broker-dealers have a steady flow of fixed insurance business revenue at the parent company that stays rather constant under all market conditions.

That revenue acts as a life jacket during market turmoil, whereas broker-dealers dependent on the markets alone have more downside exposure.

PE-Owned BDs

There are two problems with private equity (PE). One is the lack of transparency and the other is the unpredictability of the ownership timeline. In spite of these factors, we’ve heard positive feedback from firms like Plan Member Securities. During the 2008-’09 bear market, Lovell Minnick’s minority stake in the firm helped it weather the storm.

We prefer larger PE firms during difficult markets, as we’ve seen some midsize PE firms overextend themselves, causing a cash crunch that spilled over to the broker-dealer in the form of staffing cuts.

LBO Private-Equity Owned BDs

Leveraged buyout (LBO) PE firms carry more risk than growth equity PE because 55%-65% of the broker-dealer purchase price is financed with junk bonds.

In addition to ratings downgrade risks during bear markets, LBO PE firms have up to half their cash flow going to interest payments on the junk bonds. When cash flow drops, the risk of staffing cuts is high. (If you want more research on the impact of LBO PE, you can request my white paper, “LBO Private Equity Makes Its Mark in the IBD Channel,” here.)

Multiple Revenue Source BDs

While some broker-dealers may do investment banking, which is in sync with market conditions, others have a strong focus on alternative investments that are less affected by market swings, which can act as a stabilizing factor for broker-dealers during difficult market conditions.

Firms that specialize in hedging products that benefit from down markets can also bring safety, versus firms that have full market exposure.

One midsize broker-dealer we’ve been favoring for its ability to hold up well in difficult markets has a deep-pocket parent company diversified in investment banking, merchant banking, asset appraisal and liquidation services, restructuring and forensic accounting and capital management, which includes alternative investments and hedge funds.

Institutional BDs

Firms that have a substantial number of representatives doing institutional business such as those that may do bond or stock trades for banks, municipalities, cities and other institutions have trade frequency that is highly predictable, which helps to buoy the downturns on the retail side.

Preparing for the Worst

When broker-dealers experience a bear market, they hunker down, often times by putting projects such as improvements in technology and services on hold.

As cash flow diminishes, you start to see staff layoffs, which will become more pronounced depending on the depth and length of the bear market as well as the firm’s exposure to market swings.

Of particular concern is the financial viability of firms under $10 million of revenue. For security of scale, we favor those with $100 million or more in revenue.

At that level, we see enough scale to minimize the concern of keeping up with FINRA requirements, the ability to compete both on service and services, and enough capital cushion to survive extended market downturns.

You hope for the best with your broker-dealer, but like a prepper, you need to plan for the worst.

This could mean implementing a “Plan B” to be ready with an alternative broker-dealer choice in the event you feel your firm is in a downward spiral, or being proactive and making a change to a broker-dealer that is on solid ground, no matter what the market conditions impose.