Is It The Right Time to Check Out These 4 BD’s?

September 20, 2022

By Jon Henschen, ThinkAdvisor

In the spirit of the show “Comedians in Cars Getting Coffee” — which features Jerry Seinfeld matching a car from his collection with a comedian he’s taking out for coffee — I decided to match up watches with four of my broker-dealer clients.

One of my outside interests is watch collecting, specifically watches in the $500-$5,000 price range. And, like with broker dealers and RIAs, I’m continuously seeking out combinations of quality and value in the watch world.

I found this pairing exercise to be very revealing in terms of the key qualities that advisors may want to look for in their broker-dealer and in their timepieces.

Read on for details on four interesting watches and four BDs, all of which I keep up with and are part of my client base as a recruiter.

Fortune Financial Service

Hamilton Khaki Field Mechanical 38 mm, $495. Movement: Swiss mechanical; power reserve: 80 hours; case size: 38 mm; crystal: sapphire; case: stainless steel; water resistance: 50 mm.

This field watch is rugged yet simple in that it only tells time. The Hamilton Field watch has great value with features like Swiss movement and a sapphire crystal typically seen in watches costing over $1000. The military heritage of this watch holds up well in outside activities and an added bonus of the second hand that freezes when the crown is pulled out; time synchronization feature needed by troops.

Like the Hamilton Field Watch, Fortune Financial has the tag line, “We keep it simple.” Fortune doesn’t use a clearing firm; it lets advisors to purchase their own errors and omissions insurance; and it stays clear of illiquid investments to mitigate risk.

The firm has some surprising value, with advisors who have their own RIA receiving 100% payouts on the advisory portion of their business. For advisors doing business under their broker-dealer RIA, Prosperity Wealth Management, Fortune makes available Black Diamond billing and statements for $32 per account annually.

By avoiding illiquid investments, not having a clearing firm (no transactional stock and bond traders) and having an impressively uneventful compliance history coupled with strong financials, Fortune Financial stays clear of higher risk investing — resulting in a BD that, like the Hamilton Field Watch, is battle ready when difficult markets inevitably occur.

(Photo: Hamilton )

Arete Wealth

Raymond Weil Freelance Caliber Skeleton RW1212, $3,095. Movement: Mechanical self-winding skeleton in-house movement, with visible balance wheel; power reserve: 38 hours; case size: 42 mm; crystal: sapphire with dual-sided antiglare treatment: case: stainless steel/bronze bezel; water resistance: 100 mm.

Skeleton watches are mechanical watches in which all of the moving parts are visible through the front and back of the watch. Raymond Weil is an independent Swiss watchmaker that offers a skeleton watch that, besides being a work of art in the looks of its movement and case, offers a true skeleton watch and proprietary movement; other brands charge thousands more for comparable quality.

The theme of the Raymond Weil is artsy and high end, making them a good match for Arete Wealth, and it is the only independent BD that has a partnership with Masterworks, a provider of art-investment securities (via it New York branch office).

Arete also has an art and wine advisory program that integrates wealth-management success with an exploration of personal passions. Serving high-end accredited and qualified investors is the primary focus for Arete; it also has lots of depth and breadth to its product offerings in alternative investments, venture capital and private equity programs.

It’s safe to assume that Joshua Rogers, the founder and CEO of Arete Wealth is the driver of the firm’s entry into art investing, as he is an elected trustee of the Museum of Contemporary Art Chicago and an avid art collector. The Raymond Weil Skeleton Watch is a great matchup of the artful and sophisticated ways in which Arete communicates its industry offerings.

(Photo: Raymond Weil)

LPL Financial

Longines Master Collection L26734783, $3,475. Movement: Automatic mechanical; power reserve: 46 hours; case size: 40 mm; crystal: sapphire; case: stainless steel; water resistance: 30 mm.

Longines is one of 18 watch companies owned by the Swatch Group, the largest watchmaker in the world. Watch features beyond telling time are referred to as complications, and watches in this Master Collection have a very high degree of complications. Functions include hours, minutes and seconds within a 24-hour indicator at 9 o’clock, a date indicator by the half-moon central hand, a moon phase display at 6 o’clock, and a data and month display at 12 o’clock.

With such a high degree of complications you’d expect the watch to be rather thick, but this watch is surprisingly thin at 14.30 millimeters. Longines’ proprietary Swiss movement along with its high degree of complications/features makes this watch the only watch in its price range to bring such a combination of high quality and complications due to the scale of Longines’ manufacturing volume.

Being the largest IBD with 20,000 advisors, the ability to offer more for less due to its scale is a given for LPL Financial. Having in-house clearing only adds to is profitability advantages compared to other large firms that don’t self-clear.

Like the Longines Master Collection watch, LPL has numerous complications/offerings in business models, technology and services. Whether you are an RIA, independent advisor, bank/credit union rep or wirehouse advisor needing office space supplied for you, LPL has multiple options to fit many needs. On technology, LPL supplies a base tech stack with a broad selection of a la cart add-on technology at deep discounts.

Services are another standout, providing licensed and trained virtual assistants, an information technology department that helps you outsource, as well as digital marketing services that yield a 90% average increase in traffic and a 45% average annual increase in social media connections and e-mail open rates that are double the industry average. It also provide CFO solutions that help advisors build better practices and accelerate growth.

Pricing is another area of value at LPL, one being billing and performance reporting on advisory services for as low as 3 basis points. This undercuts much competition. Like the Longines Master Collection watch, LPL’s scale and services provide a high degree of quality and value.

(Photo: Longines)

United Planners Financial Services of America

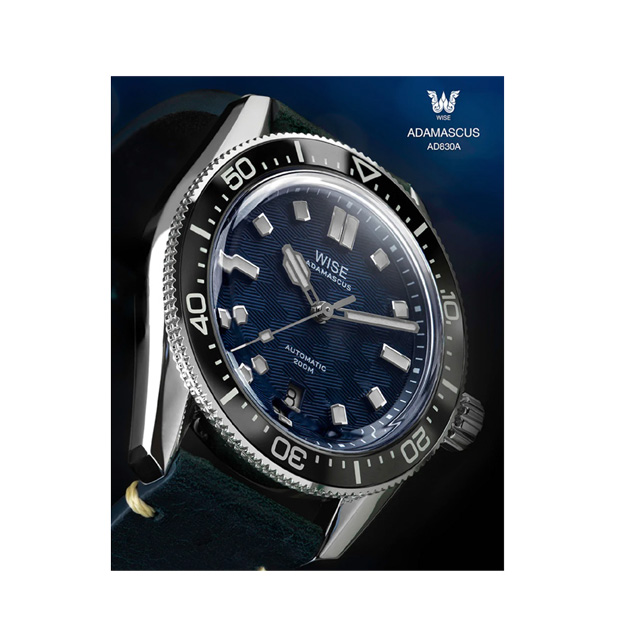

Wise Adamascus AD830A, $830 (intro priced at $599). Movement: Miyota automatic, 24 jewels; power reserve: 42 hours; case size: 40 mm; crystal: sapphire with super-AR; case: stainless steel 904L; water resistance: 200 mm.

Recently, I bought this dive watch and love it. For a dive watch, it’s unusually thin at 12 mm, and it has features that you see on dive watches costing over $2,000, such as the 904L steel case, which is the same hardness of steel used by Rolex.

The watch also has a screw-down back with a Viton gasket, along with a screw-down crown offering enhanced water resistance. This watch also offers great value with a ceramic bezel that is lumed (or luminescent), along with ample Super-Luminova on the dial. This gives the Adamascus a bright night-glow reading that is top notch. Wise Adamascus is a micro-brand watch maker based in Taiwan. Micro-brand watchmakers make an impact by oftentimes offering more for less to gain market share, which holds true with Wise watches.

United Planners reflects the qualities of Wise in that you get more for less. UP also reflects the economic freedom of Taiwan, with its advisors having freedom when it comes to where they can custody advisory assets; 93% of advisory assets are held at Fidelity Institutional Wealth Services, Charles Schwab, turnkey asset management programs (TAMPs) and third-party money managers (TPMMs) without platform fees.

Freedom also pervades in United Planner’s technology choices; while most BDs choose a tech stack, UP has an agnostic approach, so advisors can plug whatever discounted technology they choose into its cloud-based system. The advisor owns the data, and there are no delays in tech updates. United Planners gives advisors freedom to offer their clients a high level of fiduciary service via a flat charge of $72 per account for billing, statements with Orion and no markups on advisory managers’ management fees.

The Wise Adamsdcus Dive Watch and United Planners are a matchup akin to the freedom enjoyed in Taiwan and micro-brand qualities in which more is offered for less to gain market share — with United Planners having grown to over $180 million of revenue.

(Photo: Wise Adamascus)

Jon Henschen is founder of Henschen & Associates, a recruiting firm that matches advisors’ needs to best fit broker-dealers and RIAs.