An Uneasy Union

by Halah Touryalai and featured in Registered Rep

November, 2009:

When AIG was nearly wiped out last year in the mortgage crisis, Stan Bivin, an advisor at one of its independent broker/dealers, says he worried about what his clients would think. Some of his good friends, who were also top producers at AIG Financial Advisors — renamed SagePoint Financial in January — left the firm in the midst of AIG’s fall from grace. But Bivin was determined to stay and deal with the uncertainty of his firm’s future. “I’d been with the firm for over twenty years. I thought it was premature to bail and take clients and transition to another firm. We didn’t feel our clients were being hurt,” he says. Now, a year after announcing its plans to sell its three independent b/ds, AIG has decided to hold onto them. Bivin is glad he stayed put. “I was surprised by the decision, but to be honest, I’m relieved and pleased that we will not be sold to a private equity or venture group,” he says.

Bivin is one of 5,000 or so reps in the AIG Advisor Group Network who decided to wait it out rather than find a new firm. While AIG’s interest in selling the b/ds was a matter of acute balance sheet distress, it isn’t the only insurance company that has considered shedding its independent b/d business. Consultants and recruiters say over the years, insurance companies that own b/ds have been back and forth over whether such unions are a good fit. “It seems that every six or seven years, insurance companies look at independent b/ds and decide they need to buy a couple to increase distribution,” says Larry Papike, president and owner of Cross-Search, a Jamul, Calif.-based recruiting firm. “Then something happens, like the market drops or there are regulatory problems, and the insurance firm debates whether it wants to sell the b/ds.”

And yet, despite the precarious nature of the insurance company-independent b/d relationship, the model seems to have stuck. Of the top 30 independent b/ds by advisor headcount, more than half, or 16, are owned by insurance companies such as AIG, ING and MetLife. Those 16 b/ds and b/d networks alone employ over 30,000 advisors. By comparison, there are just 18,582 advisors in the Registered Investment Advisor (RIA) channel and about 55,000 total wirehouse reps. (See tables on page s13.) Most of the advisors at insurance -owned b/ds were already working there when the insurance firms snapped them up, says Dennis Gallant, principal of consulting firm Gallant Distribution Consulting in Sherborn, Mass. “It was a matter of consolidation in the industry,” he says.

So what’s in it for reps? All of the insurance-owned b/d networks claim that they have a distinct advantage over rival independents because their insurance parent companies have deep pockets, which spells both security and generous investment in b/d infrastructure and services. But while some insurance b/ds do, in fact, make substantial investments in their b/ds, others lag behind in technology and platform offerings, say analysts. “Insurance b/ds are rarely on the cutting edge of technology,” says John Henschen, president of Henschen & Associates, a St. Croix, MN-based firm that recruits for independent b/ds, including insurance-owned b/ds. “They’re not terrible at it, but the best technology is usually at non-insurance firms. There are some insurance b/ds that will use the ‘deep pockets’ line to instill fear in a prospective rep who is considering joining a privately owned b/d.”

Meanwhile, an industry-wide perception that insurance-owned independent b/ds are not truly independent persists. Of course, the reps at these b/ds are, in fact, independent contractors, and the insurance firms stopped offering their b/d reps financial incentives to sell their own products years ago. (Some insurance firms used to offer a 100 percent payout for sales of their own insurance products.) Still, some firms don’t make rival products available on their platforms where these compete directly with their own, and they make sure that their own wholesalers have better access to their reps.

“We’ve seen them restrict some competitor products but less so over the last two years,” says Henschen. “They can also restrict competing products from being able to wholesale their products to their reps. The product is available but the other companies’ wholesalers may not be able to go out and talk about their products directly with their reps. Meanwhile, insurance b/d’s own proprietary product wholesalers have unlimited access to their reps through visits, e-mail, regional meetings and at conferences.“Deep Pockets?

Bing Waldert, of Cerulli Associates, says the first question an advisor should ask about an insurance owned independent b/d is: What is the b/d’s role in the organization? “Traditionally, these insurance-owned b/ds have been run at a loss. The insurance company knows it needs to be open architecture to attract advisors, but at the same time it still views its b/ds as a place where it can distribute products for free,” says Waldert. “Advisors who are thinking about joining one of these firms should try and decide if the b/d is expected to be a profit center for the corporate parent, or if it’s just a place for the insurance company to sell its products,” Waldert says.

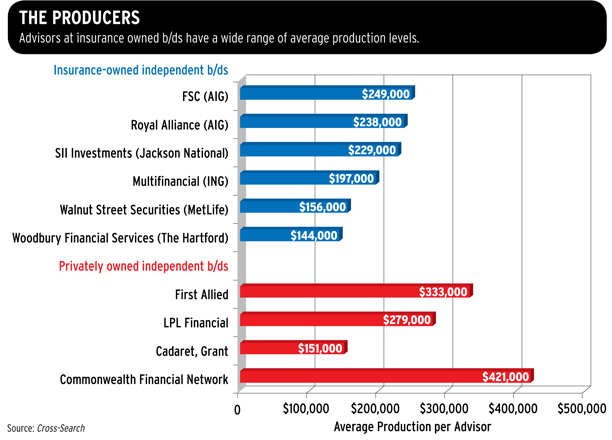

A good way to determine that is to find out how much the corporate parent is investing in the b/d. “To what extent is the parent investing in the back office, the platform and technology? Is the firm trying to attract top advisors? Is the firm able to attract and recruit $300,000 producers from other independent b/ds? Those answers can help determine what kind of insurance-owned b/d it is,” Waldert says.

According to John J. Brett, Senior Vice President of the MetLife Broker-Dealer Group, MetLife has invested over $20 million in its network of b/ds over the past two years. This spending went in part to a number of technology upgrades and new tools for advisors. The firm rolled out its MetLife Fund Management Service in August, which is geared to “emerging investors” (with at least $10,000 in assets). It allows investment advisors to offer advice to smaller clients more efficiently through account maintenance and support, as well as consolidated statements and tax reporting. And in April, MetLife b/d group launched the second generation of its Wealth Management Services platform. The new version of the platform added new products including a flexible unified managed account, mutual fund wrap, custom mutual fund wrap and separately managed accounts.

The $20 million figure represents a substantial investment. But as far as the new products on the firm’s platform go, that is just a matter of catching up. Mutual fund wraps and separately managed accounts are not novel or special among independent b/ds with at least 800 reps, according to Waldert. Chip Roame, principal of Tiburon Strategic Advisors, an industry research and consulting firm, agrees that this is standard at large independent b/ds like Commonwealth, Raymond James and LPL.

Jim Livingston, CEO of National Planning Holdings B/D Network, a Jackson National Life affiliate, says his firm can’t break out the dollar expenditures Jackson National makes on its b/ds because that information is proprietary and cannot be disclosed. But he says the parent company has most recently used its deep pockets to help its advisors shift to a paperless office. Right now, when advisors open mutual fund accounts for clients, all the paperwork is eliminated and made electronic. Livingston says the electronic process will be available for variable annuities as well in the next 18 months. “Look, most reps don’t want the Jackson National shingle hanging on their door anyway. They just want to know that the parent company can offer the best platform, tools and technology,” Livingston adds.

Paperless office capabilities are not particularly revolutionary in this day and age, but there are plenty of smaller b/ds who still haven’t made the conversion, says Henschen. Such an investment indicates at least a certain level of commitment to the b/d business.

Like Jackson National, many of the big insurance firms declined to offer details on exactly how much they had invested in their b/ds, or what kinds of investments they made. “We’ll decline to give specifics but I will say that AIG invests heavily in Advisor Group and our individual broker-dealers,” says Larry Roth, CEO of AIG Advisor Group. ING’s Advisor Network was not able to respond to requests for comment on the investments its parent company makes in the b/ds.

“Some invest in their b/ds, and some don’t,” says Henschen. “There are firms out there that just coast along with their technology and aren’t keeping up with the competition. Others are spending lots of money by adding practice management services, marketing help, and there is probably a higher staff to rep ratio. About half of the insurance companies out there are spending money on their b/ds, the other half are not spending as much.”

Independence Day

With or without such investments, National Planning’s Livingston says there’s no merit to claims that insurance owned b/ds are not truly independent. “I was recently talking to an executive of a privately owned independent b/d, and he said he always tells prospects not to join insurance owned firms because there’s a lot of pressure to sell the insurance company’s products,” says Livingston. “I know he and others are telling advisors that, and I stand here all day telling those prospects it’s not true. It’s always a back and forth. Advisors at our firms know there’s no pressure to sell anything.”

National Planning consists of four independent b/ds and 3,500 advisors. National Planning’s parent company Jackson National acquired and assembled the b/ds (which include Invest Financial, Investment Centers of America, National Planning Corp. and SII Investments) about ten years ago. Before then, Jackson was manufacturing its products and distributing them (mostly variable annuities and life insurance) through about 800 outside independent b/ds. “We felt we might be better off owning a few independent b/ds ourselves. But that doesn’t mean they’re here to push Jackson products. Our advisors have access to variable annuities from all 20 of the largest manufacturers, for example,” Livingston says.

MetLife’s Brett says firms like his can’t dictate how advisors should run their businesses. The MetLife b/d group is made up of four b/ds including two independents — Walnut Street Securities and Tower Square Securities. Combined, the two firms have about 1,300 reps. “The idea that independent b/ds exist in insurance companies to just sell certain products is old,” says Brett.

Papike says sometimes insurance companies will buy up b/ds thinking it will be a good place they can distribute their own insurance products, but that it usually doesn’t work out that way. “First they might think, ‘This is great. There are all these brokers that will sell our products with less cost to us because they operate under our own umbrella.’ [The insurance companies] think they’ll be getting more distribution of the products that make them the most profit, like life insurance. But that almost never happens. If they push for their products to get sold, the reps usually push back and say, ‘No way.’ The independent contractor rep is usually fiercely independent,” says Papike.

On The Block

This tension between the insurance companies’ desire to gain added distribution of their products, and their inability to encourage such distribution too directly is partly what fuels the constant back and forth over whether to buy, keep, or sell the independent b/ds, say analysts.

While many of the insurance owned b/ds turn a profit for their parent companies, it’s probably not much, says Dennis Gallant, who estimates insurance owned b/ds have profit margins of 3 to 5 percent. By comparison, non-insurance-owned independent b/ds generally have profit margins of 5 to 10 percent. Insurance companies first began buying up independent b/ds two decades ago. Since then, a number of them have talked about offloading their b/ds and focusing on their core businesses instead. Amsterdam-based ING Group is currently thinking about doing just that with its three independent b/ds. But few details are forthcoming. “We’re in the midst of a comprehensive strategic review about the future of the broker/dealer network,” says Dana Ripley, a spokesperson for ING Americas. “We are making steady progress, but the review is not yet complete. We expect it to conclude soon.”

The problem for insurance companies looking to put their b/ds on the block is that there are no buyers out there right now, some industry watchers say. “I would bet the reason AIG changed its mind about selling its b/ds is because it didn’t see the price it was looking for,” says one industry consultant who asked to remain unnamed because he works with the AIG’s b/ds. Bill McGovern, a former business development executive for Raymond James Financial Services, who now operates consulting firm B/D Search in St. Petersburg, Fla., says ING might find itself in a similar boat.